2025 Irs Estimated Tax Payment Form. Learn how and when to make an estimated tax payment in 2025 — plus find out whether you need to worry about them in the first place. Pay balance due, payment plan, estimated tax and more;

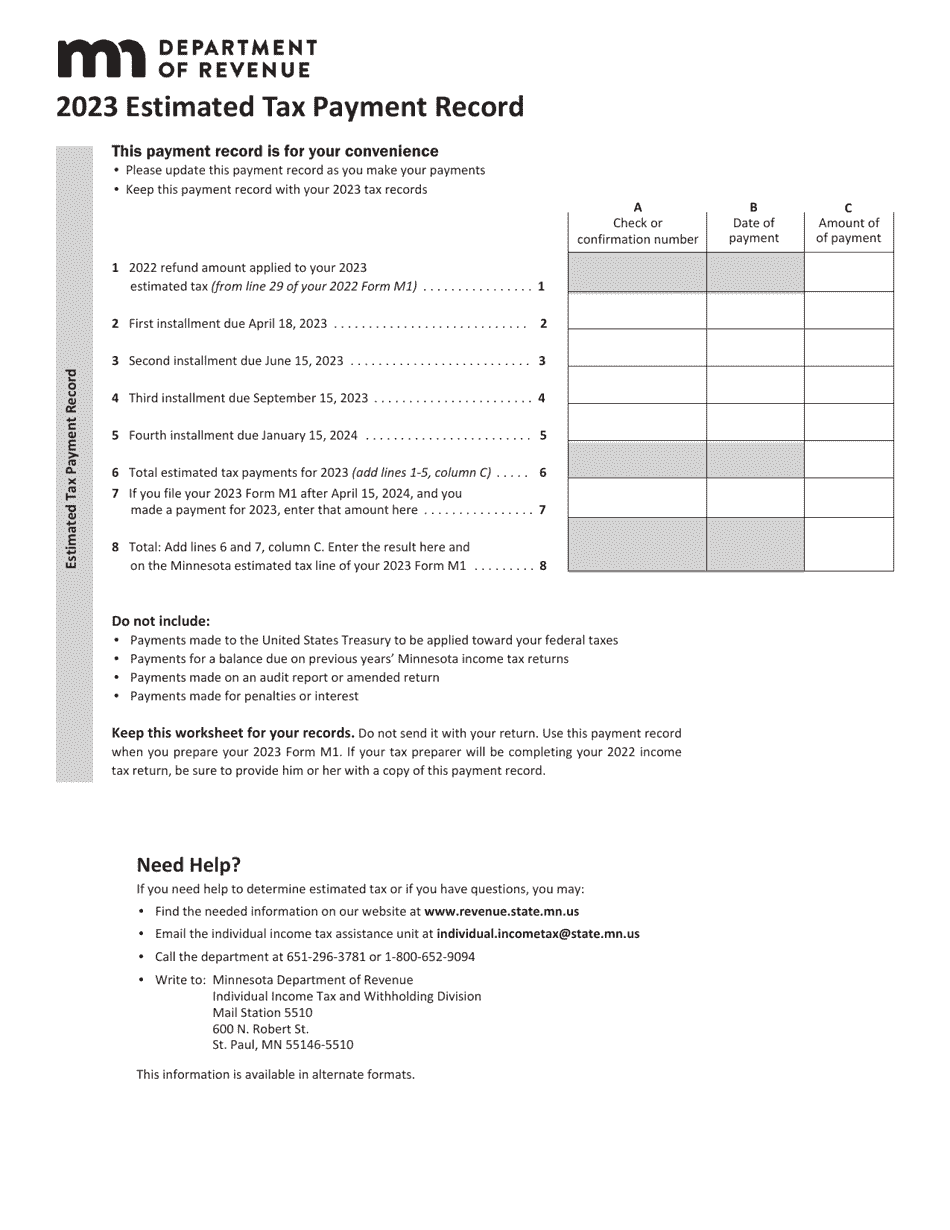

How to use the irs estimated tax worksheet to calculate your tax bill. You can pay your estimated taxes using the irs direct pay system online, by phone, or by mailing a check or money order with a completed form 1040.

Estimated Tax Payments 2025 Due Dates Kaja Salome, There are four payment due dates in 2025 for estimated tax payments:

Estimated Tax Payments 2025 Dates Nj Amabel Jerrilee, By proactively managing your estimated tax payments, you can achieve peace of mind and even a healthier cash flow by eliminating large lump sum payments on tax day and.

Tax Return Form 2025 … Erna Halette, This blog will explore who qualifies for this requirement, outline methods for calculating estimated tax obligations, and detail the relevant payment deadlines for the 2025 tax year, ensuring a.

Estimated Tax Payments 2025 Due Dates Canada Frieda Lynnell, As we approach the 2025 tax year, it's crucial for taxpayers, particularly those without withholding, to understand the estimated tax payment process.

Estimated Tax Payments 2025 Irs Form Sibyl Dulciana, This blog will explore who qualifies for this requirement, outline methods for calculating estimated tax obligations, and detail the relevant payment deadlines for the 2025 tax year, ensuring a.

Irs Forms 2025 Estimated Tax Payments Form Dana Milena, Pay balance due, payment plan, estimated tax and more;