Corporate Transparency Act 2025 Exemptions List. An entity that qualifies under any of these 23 exemptions will not need to file a boi report, unless the company later becomes nonexempt. The 23 exemptions from the corporate transparency act’s beneficial ownership information reporting requirement.

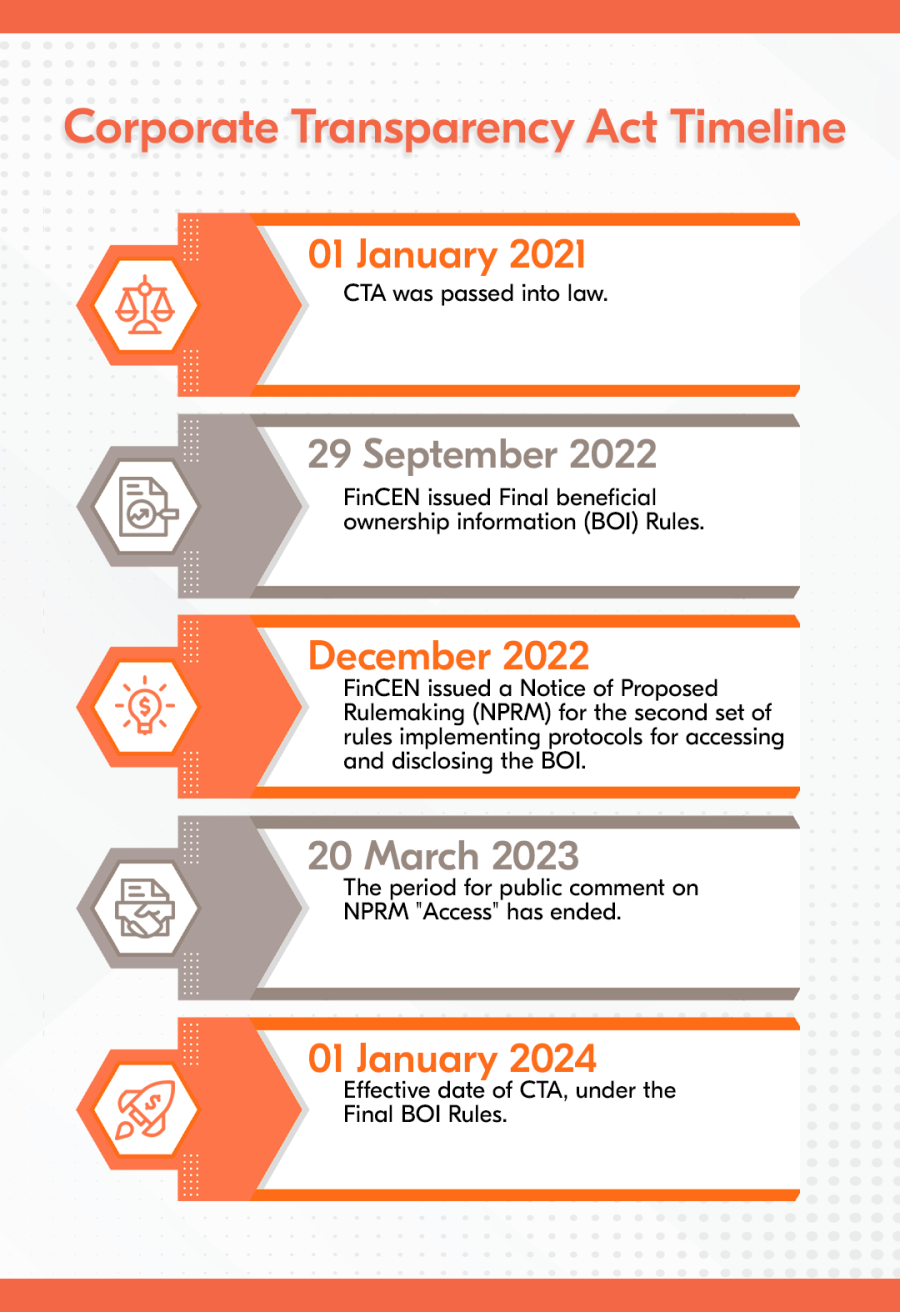

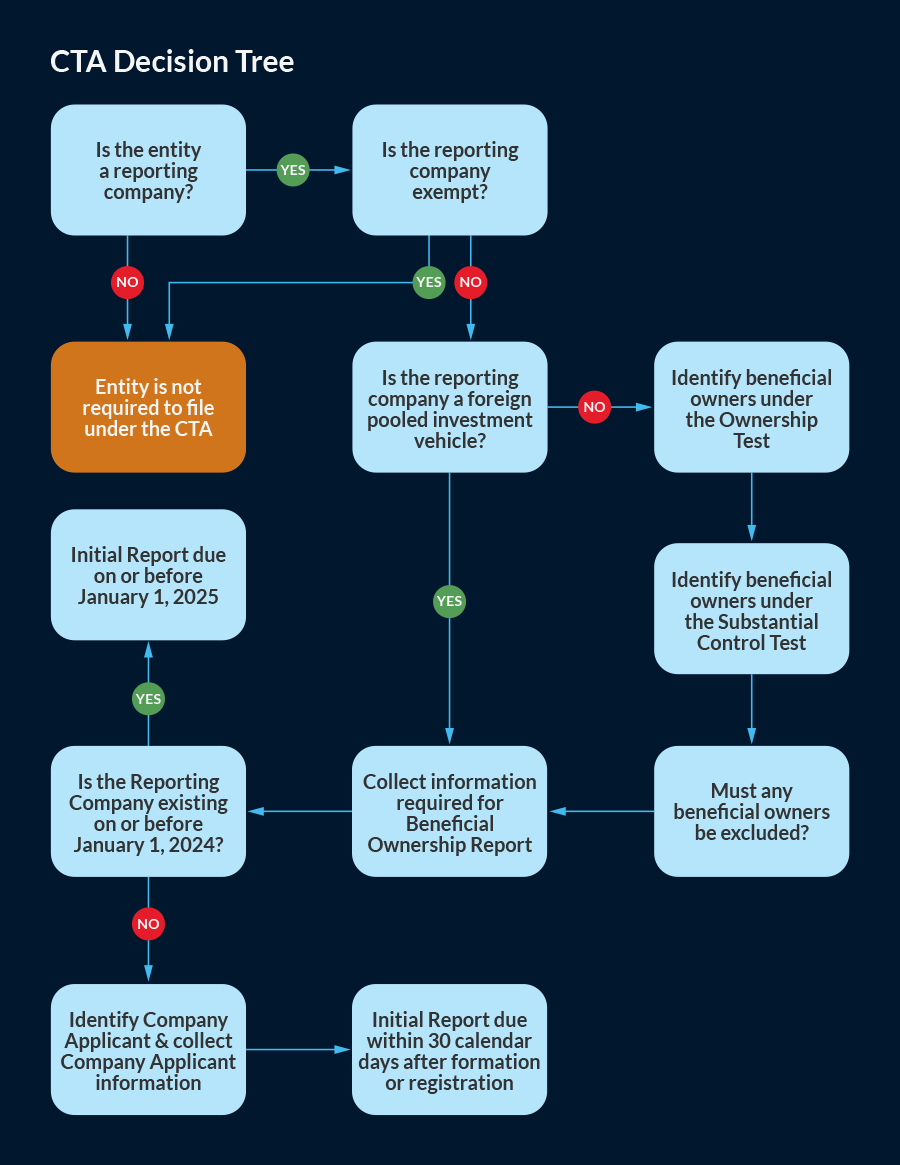

The corporate transparency act is a significant piece of legislation impacting small business entities that has specific reporting requirements and severe consequences for non. Understand key provisions, reporting requirements, and exemptions to ensure compliance and avoid hefty fines.

What Businesses Need to Know Now About The Corporate Transparency Act, The corporate transparency act (cta) 2025 outlines 23 exemptions for entities that do not need to file a beneficial ownership information (boi) report with fincen.

An Overview of the US Corporate Transparency Act Bolder Group, The corporate transparency act is a significant piece of legislation impacting small business entities that has specific reporting requirements and severe consequences for non.

Corporate Transparency Act 2025 Exemptions Reine Charlena, Understand key provisions, reporting requirements, and exemptions to ensure compliance and avoid hefty fines.

Corporate Transparency Act 2025 Update Hilger Hammond, Additional corporate transparency act exemptions apply to businesses in certain sectors:

Corporate Transparency Act 2025 Exemptions Effie Gilberte, The new year's day deadline is fast approaching for companies formed before january 1, 2025, to report beneficial ownership information under the corporate.

Corporate Transparency Act means new ownership reporting requirement, Steps for hoa board members to take.

Beneficial Ownership Form Fill Out Sign Online Dochub vrogue.co, Due to the replanning required because of the change of government, the financial.

Corporate Transparency Act — Beneficial Ownership Information Reporting, With the beneficial ownership information reporting requirement.

Corporate Transparency Act What You Need to File and When, The financial crimes enforcement network (fincen) released new guidance on beneficial owners, company applicants and reporting company exemptions under the.