Household Employee Threshold 2025. In 2025, you must withhold and pay fica taxes if your household worker earns cash wages of $2,700 or more (excluding the value of food and lodging). Adaptation on 1 january 2025 of the wage amounts determined by the employment contract act of 3 july 1978 to the general index of conventional wages for non.

For 2025, the domestic employee coverage threshold amount is $2,800, and the coverage threshold amount for election officials and election workers is $2,400. In 2025, you must withhold and pay fica taxes if your household worker earns cash wages of $2,700 or more (excluding the value of food and.

2025 Household Employee Threshold Wanda Joscelin, In 2025, you must withhold and pay fica taxes if your household worker earns cash wages of $2,700 or more (excluding the value of food and lodging).

Medical Household Limit 2025 Liza Thelma, Provisional salary thresholds for the 30% rule in 2025.

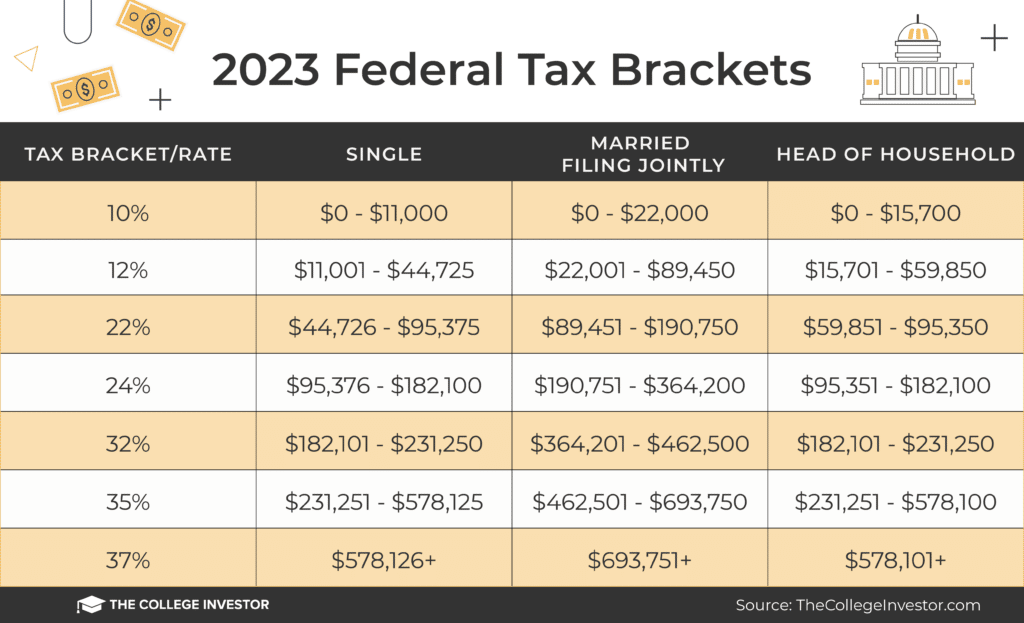

2025 Tax Brackets For Married Filing Jointly Beginning Of Ramadan 2025, On 30 october, the government announced changes to the national insurance contributions (nics) secondary threshold, secondary class 1 rate, an increase in employment allowance.

Federal Tax Brackets After 2025 A Comprehensive Overview Beginning, Provisional salary thresholds for the 30% rule in 2025.

Singapore 2025 Employment Pass Salary Threshold Changes, As a result, employers will have more flexibility in.

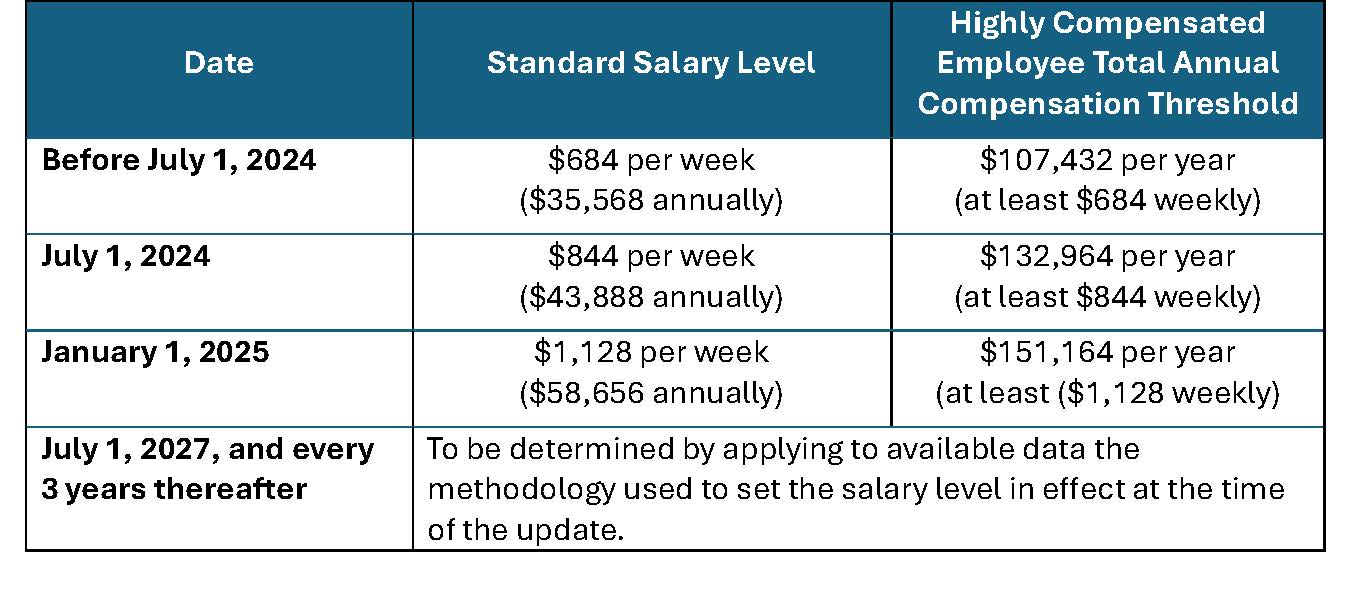

Federal Exempt Salary Threshold 2025 Alie Lucila, As a result, employers will have more flexibility in.

New Salary Threshold for Exempt Employees Takes Effect July 1, 2025, In 2025, you must withhold and pay fica taxes if your household worker earns cash wages of $2,700 or more (excluding the value of food and lodging).

US DOL Issues Final Rule Raising Salary Threshold for FLSA “White, In 2025, you must withhold and pay fica taxes if your household worker earns cash wages of $2,700 or more (excluding the value of food and lodging).

Limits For Obamacare 2025 Aggie Starlene, In 2025, you must withhold and pay fica taxes if your household worker earns cash wages of $2,700 or more (excluding the value of food and.

Minimum Salary Threshold 2025 Randa Carolyne, On 30 october, the government announced changes to the national insurance contributions (nics) secondary threshold, secondary class 1 rate, an increase in employment allowance.