Medicare Fica Rate 2025. 29 rows tax rates for each social security trust fund. The federal insurance contributions act, commonly known as fica , is.

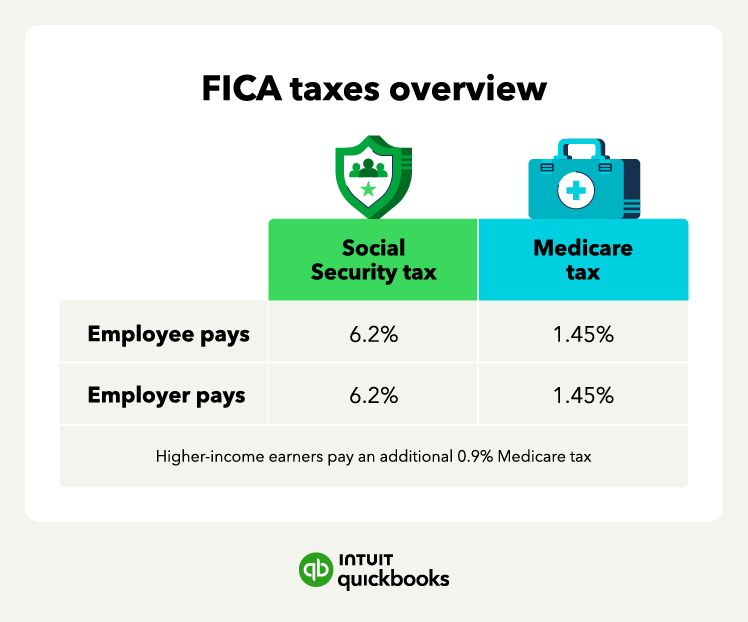

The rate is for both employees and employers, according to the internal revenue code. Specifically, 6.2% of an employee’s gross.

Fica And Medicare Rates 2025 Riva Verine, Fica combines social security and medicare taxes for a total rate of 15.3%, but the cost is split between each party.

Employer Fica And Medicare Rates 2025 Lok Britt Colleen, The medicare tax funds the medicare program, which provides healthcare benefits to individuals aged 65 and older and certain groups of.

Social Security And Medicare Withholding Rates 2025 Berri Guillema, This is your definitive guide to understanding the fica tax rate for 2025.

Fica Medicare Percentage 2025 Calendar Pooh Ulrika, Fica (federal insurance contributions act) tax is made up of two different taxes.

Calculate fica and medicare withholding IanAnnaleigh, The medicare tax rate for 2025 remains at 1.45% of all covered earnings for employers and employees.