As we approach the dawn of a new year, individuals across the nation eagerly anticipate the release of the latest paycheck calculator for 2025. This essential tool empowers employees with the ability to accurately calculate their net earnings, taking into account various deductions and taxes that may impact their income.

The New Paycheck Calculator 2025 incorporates the most up-to-date federal, state, and local tax rates, ensuring that users receive the most accurate and reliable information available. With its user-friendly interface and comprehensive calculation capabilities, the paycheck calculator provides a valuable resource for individuals seeking to manage their finances effectively.

With the New Paycheck Calculator 2025, you can confidently manage your finances and make informed decisions about your income.

The New Paycheck Calculator 2025 is designed to provide highly accurate calculations, ensuring that users receive a precise estimate of their net earnings. This is achieved through the incorporation of the most up-to-date federal, state, and local tax rates, as well as the inclusion of a comprehensive range of deductions.

By utilizing these up-to-date tax rates and incorporating a comprehensive range of deductions, the New Paycheck Calculator 2025 provides users with highly accurate calculations that they can rely on for effective financial planning.

The New Paycheck Calculator 2025 incorporates the most up-to-date federal, state, and local tax rates to ensure that users receive the most accurate calculations possible. This is particularly important as tax laws and rates are subject to change over time.

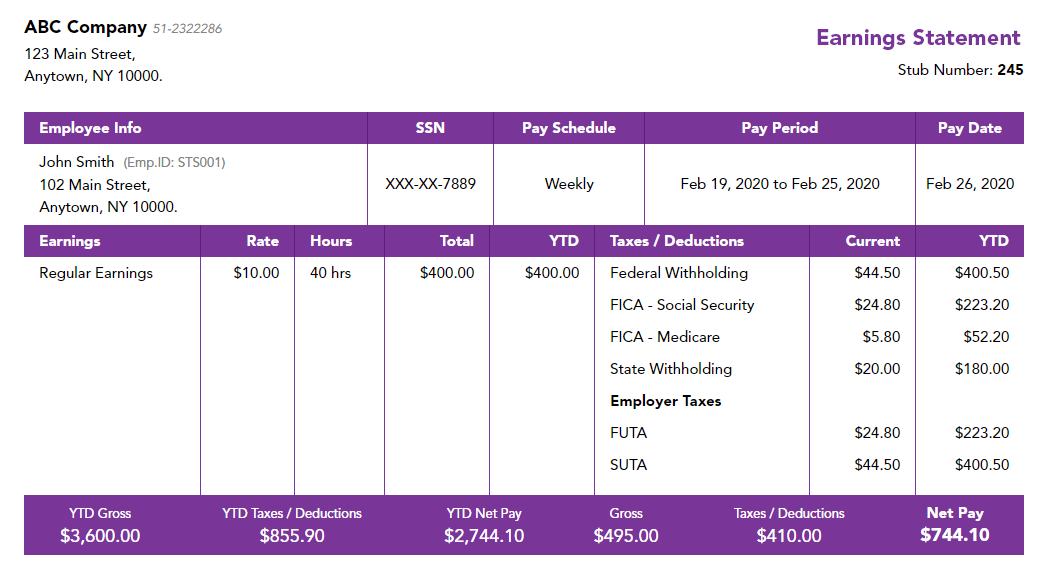

Federal Income Tax: The calculator utilizes the latest federal income tax brackets and withholding tables issued by the Internal Revenue Service (IRS). These brackets and tables determine the amount of federal income tax that should be withheld from each paycheck based on the employee’s income and filing status.

State Income Tax: For users residing in states with a personal income tax, the calculator incorporates the applicable state income tax rates and withholding tables. These rates and tables vary from state to state and are subject to change based on state legislation.

Local Income Tax: In certain localities that impose a local income tax, the calculator includes the relevant local tax rates and withholding tables. Local income taxes are typically levied in addition to state income taxes and can vary significantly from one locality to another.

By incorporating the most up-to-date tax rates, the New Paycheck Calculator 2025 ensures that users receive accurate calculations that reflect the current tax laws and regulations. This allows individuals to confidently estimate their net earnings and make informed financial decisions.

![[FREE] Biweekly Payroll Calendar Google Sheets 2025 YouTube](https://i.ytimg.com/vi/2Keo0ZBxcdQ/maxresdefault.jpg)

The New Paycheck Calculator 2025 includes a comprehensive range of deductions that allow users to accurately estimate their taxable income. Deductions reduce the amount of income subject to taxation, thereby lowering the overall tax liability.

By incorporating a comprehensive range of deductions, the New Paycheck Calculator 2025 empowers users to accurately estimate their taxable income and maximize their tax savings.

The New Paycheck Calculator 2025 is designed with a user-friendly interface that makes it easy for individuals to calculate their net earnings. The calculator features a simple and intuitive layout, with clear instructions and helpful tooltips to guide users through the process.

The user-friendly interface of the New Paycheck Calculator 2025 ensures that individuals can effortlessly calculate their net earnings, regardless of their technical proficiency or financial background.

Upon completion of the calculation process, the New Paycheck Calculator 2025 presents a comprehensive breakdown of the user’s net earnings. This detailed report provides a clear and concise summary of the user’s financial situation.

The detailed results provided by the New Paycheck Calculator 2025 empower users to understand the composition of their paycheck and make informed decisions about their financial management.

One of the key advantages of the New Paycheck Calculator 2025 is that it is completely free to use. Individuals can access the calculator online without any subscription fees or hidden charges.

By offering free access to the calculator, the New Paycheck Calculator 2025 empowers individuals to take control of their finances and make informed decisions about their earnings.

The New Paycheck Calculator 2025 is conveniently accessible online, providing users with the flexibility to calculate their net earnings from anywhere with an internet connection.

The online accessibility of the New Paycheck Calculator 2025 empowers individuals to calculate their net earnings anytime, anywhere, without the constraints of geographical location or device limitations.

To assist users with common questions and provide additional guidance, we have compiled a list of frequently asked questions (FAQs) about the New Paycheck Calculator 2025:

Question 1: How frequently are the tax rates updated in the calculator?

Answer 1: The New Paycheck Calculator 2025 is regularly updated to incorporate the latest federal, state, and local tax rates. The calculator utilizes the most up-to-date tax tables and withholding schedules issued by the relevant tax authorities to ensure accurate calculations.

Question 2: Can I use the calculator to calculate my net pay for multiple pay periods?

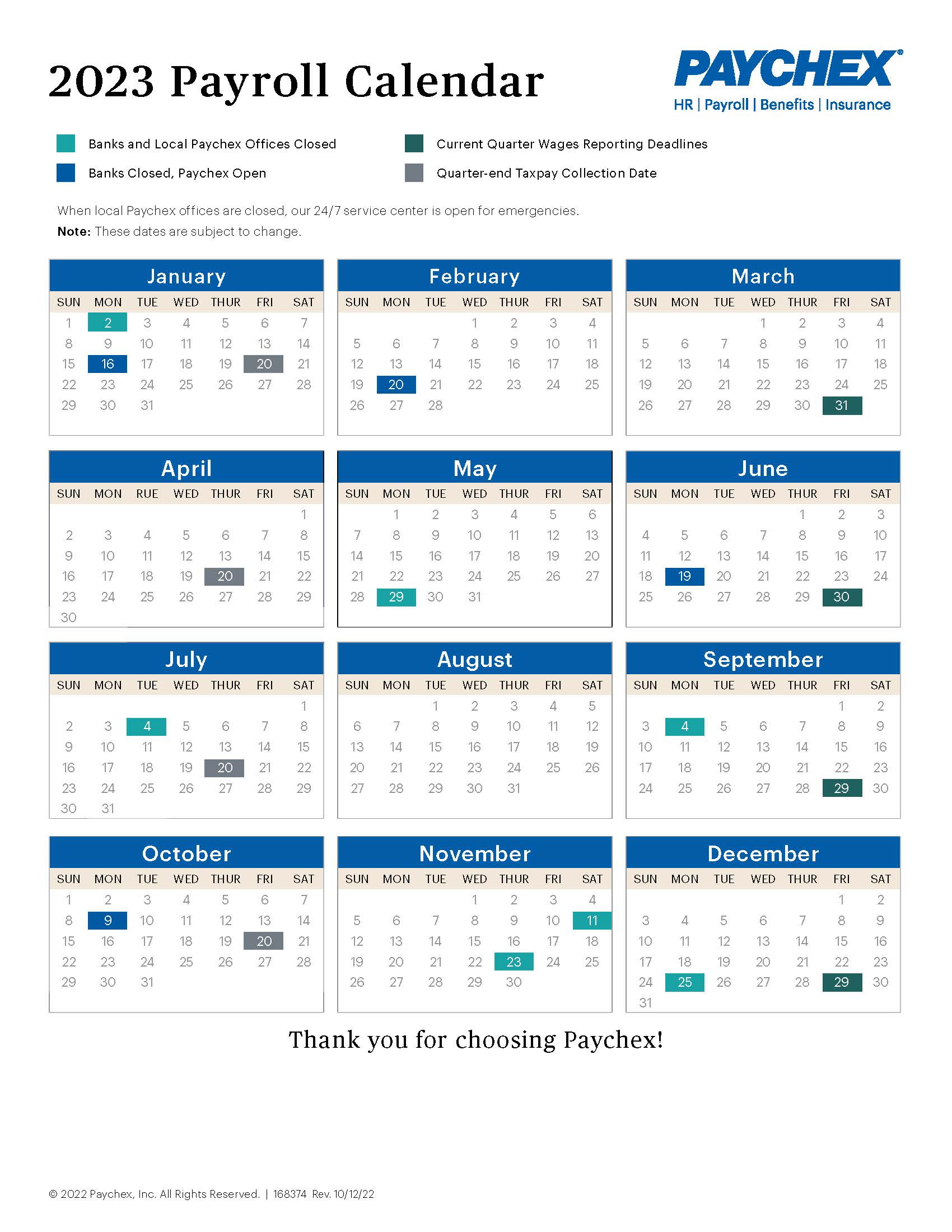

Answer 2: Yes, the calculator allows users to specify the pay period for which they want to calculate their net earnings. Users can choose from common pay periods such as weekly, bi-weekly, semi-monthly, and monthly.

Question 3: What types of deductions can I include in the calculation?

Answer 3: The New Paycheck Calculator 2025 supports a comprehensive range of deductions, including federal income tax, state income tax, Social Security tax, Medicare tax, and various other common deductions such as 401(k) contributions, health insurance premiums, and flexible spending accounts.

Question 4: How do I handle irregular income or bonuses?

Answer 4: The calculator provides an option for users to include irregular income or bonuses in their calculations. Users can specify the amount and frequency of such income to get an accurate estimate of their net earnings.

Question 5: Can I save and share my calculations?

Answer 5: Yes, the calculator allows users to save their calculations for future reference or share them with others via email or social media.

Question 6: Is the calculator secure?

Answer 6: The New Paycheck Calculator 2025 utilizes secure encryption protocols to protect user data and ensure the privacy and confidentiality of all financial information entered into the calculator.

We encourage users to explore the calculator and its features to fully understand its capabilities. If you have any further questions or require additional assistance, please do not hesitate to contact us for support.

In addition to the comprehensive FAQ section, we have compiled a list of tips to help users optimize their experience with the New Paycheck Calculator 2025. These tips will guide users through effective utilization of the calculator to ensure accurate and insightful financial planning.

Tip 1: Gather Accurate Information: Before using the calculator, gather all necessary information, including your gross income, deductions, and tax rates. Accurate input will ensure reliable and precise results.

Tip 2: Explore Different Scenarios: The calculator allows you to adjust your income and deductions to see how they impact your net pay. Use this feature to explore different financial scenarios and make informed decisions.

Tip 3: Review Your Results: Once you have calculated your net pay, carefully review the results to ensure that all deductions and taxes have been accounted for. If something seems amiss, double-check your input or consult with a financial professional.

Tip 4: Save and Share Calculations: Utilize the save and share features to keep a record of your calculations or share them with others who may benefit from the information.

By following these tips, you can effectively harness the capabilities of the New Paycheck Calculator 2025 to gain valuable insights into your financial situation and make informed financial decisions.

The New Paycheck Calculator 2025 is an indispensable tool for individuals seeking to accurately estimate their net earnings and optimize their financial planning. By incorporating the latest tax rates, supporting a comprehensive range of deductions, and providing user-friendly features, the calculator empowers users to take control of their finances and make informed decisions about their income.

The New Paycheck Calculator 2025 is an invaluable resource for individuals seeking to accurately calculate their net earnings and gain insights into their financial situation. Its comprehensive features, including up-to-date tax rates, a wide range of deductions, and user-friendly functionality, empower users to make informed decisions about their income.

Whether you are planning your budget, exploring different financial scenarios, or simply want to understand how your paycheck is calculated, the New Paycheck Calculator 2025 provides the necessary tools and information to help you achieve your financial goals. By leveraging this powerful tool, you can confidently navigate the complexities of payroll calculations and take control of your financial well-being.