Social Security Cap On Earnings 2025. Be under full retirement age. (the figure is adjusted annually based on national changes in average wages.) you lose $1 in benefits.

(the figure is adjusted annually based on national changes in average wages.) you lose $1 in benefits. In 2025, the earnings limit for early claimants is $22,320.

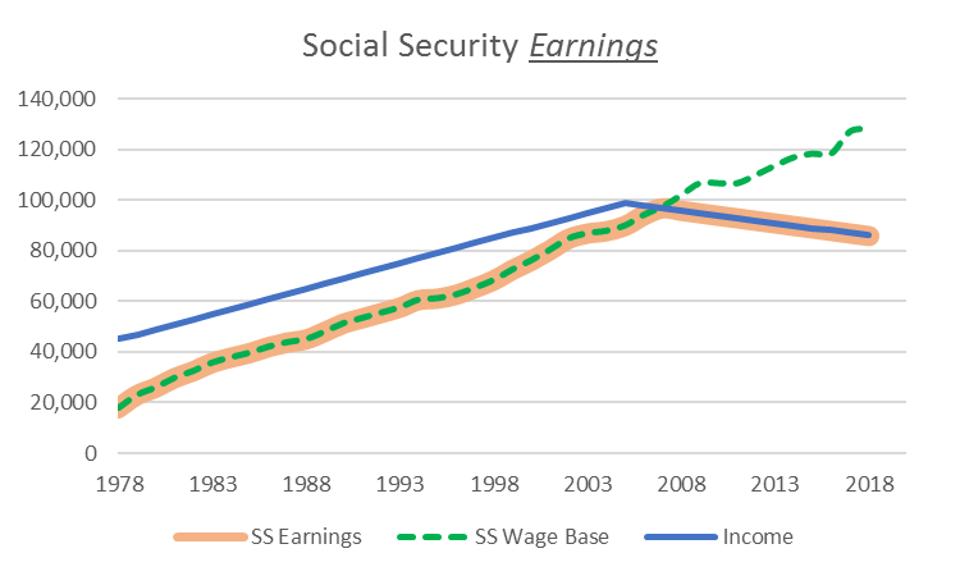

11 rows maximum taxable earnings ( en español) if you are working, there is a limit on the amount of your earnings that is taxed by social security.

![Social Security Wage Base 2025 [Updated for 2025] UZIO Inc](https://www.uzio.com/resources/wp-content/uploads/2021/09/Social-Security-Wage-Base-Table-2023-1024x791.png)

Social Security Wage Base 2025 [Updated for 2025] UZIO Inc, At the same time, the average monthly benefit amounted to a modest $1,688 in 2025. (the figure is adjusted annually based on national changes in average wages.) you lose $1 in benefits.

Limit For Maximum Social Security Tax 2025 Financial Samurai, At the same time, the average monthly benefit amounted to a modest $1,688 in 2025. What is the social security tax limit?

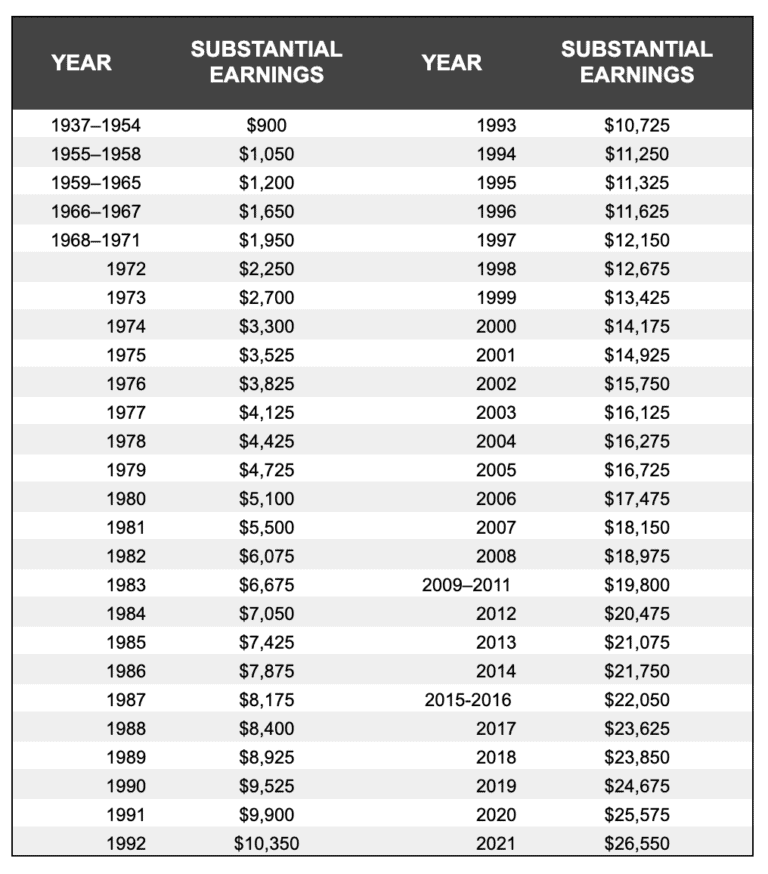

Substantial Earnings for Social Security’s Windfall Elimination, You are entitled to $800 a month in benefits. What is the social security tax limit?

Social Security Benefits Chart, The special rule lets us pay a full social security check for any whole month we consider you retired, regardless of your yearly earnings. 50% of anything you earn over the cap.

The Problem With Lifting Social Security’s Earnings Cap Manhattan, 11 rows maximum taxable earnings ( en español) if you are working, there is a limit on the amount of your earnings that is taxed by social security. The limit is $22,320 in 2025.

What Counts Towards Social Security Earnings Limit 2025 Geneva, The maximum amount of earnings subject to the social security tax (taxable maximum) will. ($9,600 for the year) you work and earn $32,320 ($10,000 more than the $22,320 limit) during.

Maximum Taxable Amount For Social Security Tax (FICA), The federal government sets a limit on how much of. You aren’t required to pay the social security tax on any income beyond the social security wage base limit.

Substantial Earnings for Social Security’s Windfall Elimination, But that limit is rising in 2025, which means seniors who are working and collecting social. The special rule lets us pay a full social security check for any whole month we consider you retired, regardless of your yearly earnings.

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes on Earnings After Full Retirement Age, Starting with the month you reach full retirement age, you. Be under full retirement age.

How Does My Affect My Social Security Retirement Benefits?, Social security allows recipients to earn income from a job and also collect benefits at the same time. Be under full retirement age for all of 2025, you are considered retired in any month that your earnings are $1,860 or less and you did not perform substantial services.